3 Red-Hot Growth Stocks to Buy in 2025 -- Including Opendoor Technologies and Broadcom

One of these growth stocks has grown by 293% over the past year.

Predicted Price is the pryogiTM prediction of where the price is going in next 3-4 quarters. There may be a revision of the predicted price every 3 months from the date of publication of the first predicted price of the stock. Price on Report Date is the price of the stock on the day prediction was published by pryogiTM. Current price shows the current price of the stock.

Margin of error shows range the price will end up in dollars either above or below the predicted price. Margin of error percentage shows the price will end up in percentage either above or below the predicted price.

Expected Returns from report date shows the returns (positive or negative) from published prediction date if you bought the stock on report date. Expected Returns from today shows the returns from today if you buy the stock today. A positive expected returns indicates a profit you will make, a negative expected return indicates a loss you will make if you buy the stock. There are different strategies to apply in the stock market for profit and loss, pryogiTM will publish such strategies in the future to help you.

PryogiTM meter shows you predicted price, price on the date this prediction was published(report date) and price of the stock today on a price scale. This indicates if the stock price is moving towards or away from the predicted price

PryogiTM performance chart shows actual movement of stock price from prediction published date(report date) and if the price is moving towards or away from predicted price

One of these growth stocks has grown by 293% over the past year.

On Monday, Cathie Wood-led Ark Invest made notable portfolio moves, boosting its positions in Qualcomm Inc ( NASDAQ:QCOM ) and BYD Co Ltd ( OTC:BYDDY ) , while trimming its stakes in Palantir Technologies Inc ( NASDAQ:PLTR ) and Shopify Inc ( NYSE:SHOP ) .

STXS expands its digital surgery vision with the EU launch of its Synchrony System and an FDA submission for market entry.

Retail investors are preparing for the first busy week in the third-quarter earnings season, with major defense contractors and other top stocks reporting. Here's a look at some retail favorites that individual investors will be watching. TSLA stock is moving. See the real-time price action here.

These companies have a habit of beating the market, and they are far from having peaked.

Intuitive Surgical enters Q3 earnings season on strong momentum, backed by robust procedure growth and da Vinci 5 adoption. However, tariff risks and global CapEx constraints remain challenges.

West Pharma's Q3 numbers hinge on robust GLP-1 and biologics demand, but labor constraints, tariffs, and plant shutdowns could test its margin resilience.

Intuitive Surgical runs a great business, but it is a one-trick pony, which may make this surgical robot competitor a better choice for you.

The biggest movers on the day were the Nasdaq, +148 points or +0.66%, and the small-cap Russell 2000 +24 points, +0.97%.

Intuitive Surgical's Ion platform gains traction in ambulatory centers, driving 52% growth as outpatient lung diagnostics accelerate.

Intuitive Surgical's stock trades down around 30% from its 52-week high.

Here are two smart ways to prepare for the next market downturn.

ISRG's growth momentum faces pressure as tariffs and China's rare earth export curbs threaten margins and supply stability.

Whether you're well steeped in Foolishness or at the beginning stages of your investing journey, these are nine foundational truths not to be forgotten.

Intuitive Surgical ( NASDAQ:ISRG ) has outperformed the market over the past 10 years by 11.05% on an annualized basis producing an average annual return of 23.6%. Currently, Intuitive Surgical has a market capitalization of $155.21 billion.

They could be excellent companies to stick with well beyond the next decade.

This stock has averaged annual gains of nearly 24% over the past decade -- and its future is bright, too.

Intuitive Surgical, Inc. (ISRG) reached $429.54 at the closing of the latest trading day, reflecting a -3.2% change compared to its last close.

Franklin Street Advisors disclosed an exit from Intuitive Surgical ( NASDAQ:ISRG ) in its latest SEC filing for the quarter ended September 30, selling 42,601 shares for an estimated $23.2 million.According to a filing with the Securities and Exchange Commission released on Thursday, Franklin ...

Intuitive Surgical shares climb after FDA clears AI-driven upgrades for its Ion platform, boosting precision and efficiency in lung biopsies.

Intuitive Surgical (ISRG) doesn't possess the right combination of the two key ingredients for a likely earnings beat in its upcoming report. Get prepared with the key expectations.

If you are looking for stocks that are unloved, this trio will fit the bill, with each offering a different long-term investment opportunity.

Breakthroughs in semiconductors, surgical robotics, and electric aircraft could send these three stocks soaring.

Intuitive Surgical's SP platform is gaining traction as a cost-efficient, high-throughput option for ASCs, complementing da Vinci 5 in hospitals.

Newest episode in C-Suite podcast series hosted by Chief Investment Officer Eric Veiel out now BALTIMORE, Oct. 8, 2025 /PRNewswire/ -- T.

Zacks.com users have recently been watching Intuitive Surgical (ISRG) quite a bit. Thus, it is worth knowing the facts that could determine the stock's prospects.

The surgical robotics pioneer could cement its leading position for years to come.

The company dominates the high-growth market of surgical robots.

These two stocks will be at the top of my shortlist of stocks to add to in October.

Motley Fool co-founder David Gardner has racked up big returns by bucking conventional wisdom.

Intuitive Surgical, Inc. (ISRG) concluded the recent trading session at $452.35, signifying a +2.11% move from its prior day's close.

Intuitive Surgical ( NASDAQ:ISRG ) has outperformed the market over the past 15 years by 6.89% on an annualized basis producing an average annual return of 19.24%. Currently, Intuitive Surgical has a market capitalization of $162.16 billion.

Beyond the big names, where are there opportunities in AI and discounts in the market overall?

An official report on October 1, 2025 reveals Senator Markwayne Mullin's recent purchase of Intuitive Surgical ( NASDAQ:ISRG ) stock, valued between $81,004 and $215,000. The transaction took place on September 24, 2025, as per the October filing.

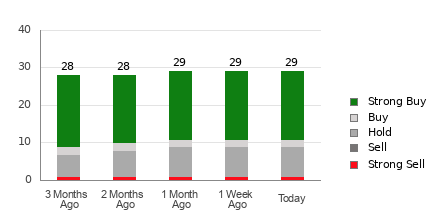

Based on the average brokerage recommendation (ABR), Intuitive Surgical (ISRG) should be added to one's portfolio. Wall Street analysts' overly optimistic recommendations cast doubt on the effectiveness of this highly sought-after metric. So, is the stock worth buying?

The growth of surgical robots is huge, and this company is looking to get in on the action while it also works to boost its profit margin.

In the current market session, Intuitive Surgical Inc. ( NASDAQ:ISRG ) share price is at $446.32, after a 0.20% drop. Over the past month, the stock went up by 0.11%, but over the past year, it actually fell by 7.92%.

Investors with a lot of money to spend have taken a bearish stance on Intuitive Surgical ( NASDAQ:ISRG ) . We noticed this today when the trades showed up on publicly available options history that we track here at Benzinga. Whether these are institutions or just wealthy individuals, we ...

Intuitive Surgical's SP platform secures new colorectal clearances, with 88% growth in procedures and rising global adoption momentum.

This is by no means an exhaustive list.

Intuitive Surgical, Inc. (ISRG) concluded the recent trading session at $447.23, signifying a +1.82% move from its prior day's close.

The company's upcoming earnings report could show just how big of a problem tariffs really are for the business.

ISRG and ZBH both push robotics forward, but valuation and Zacks Rank tilt near-term upside toward Zimmer Biomet. Which one offers a better bet?

The U.S. Commerce Department, under the Trump administration, has launched a national security review of medical imports-including PPE, consumables, and medical devices-to assess reliance on foreign suppliers for critical health products.

Surgical technology is advancing quickly, and robots are the future, which is why you'll want to look at this high-yield surgical robot maker.

Robotics is poised for robust long-term growth. Watch PATH, CDNS, NVDA and AMD for potential market dominance across sectors.

Zacks.com users have recently been watching Intuitive Surgical (ISRG) quite a bit. Thus, it is worth knowing the facts that could determine the stock's prospects.

Intuitive Surgical's SP platform gains momentum with 112% growth in Korea and steady European uptake, highlighting global adoption despite regional headwinds.

Intuitive Surgical, Inc. (ISRG) closed the most recent trading day at $444.55, moving +1.33% from the previous trading session.

Intuitive Surgical ISRG has outperformed the market over the past 15 years by 6.67% on an annualized basis producing an average annual return of 19.12%. Currently, Intuitive Surgical has a market capitalization of $159.36 billion.