Abbott Q3 Earnings Review: Tariff, Diagnostics Cap Near-Term Gains

Abbott posts strong Q3 growth across key segments, but tariff pressures and weak Diagnostics weigh on near-term momentum.

Predicted Price is the pryogiTM prediction of where the price is going in next 3-4 quarters. There may be a revision of the predicted price every 3 months from the date of publication of the first predicted price of the stock. Price on Report Date is the price of the stock on the day prediction was published by pryogiTM. Current price shows the current price of the stock.

Margin of error shows range the price will end up in dollars either above or below the predicted price. Margin of error percentage shows the price will end up in percentage either above or below the predicted price.

Expected Returns from report date shows the returns (positive or negative) from published prediction date if you bought the stock on report date. Expected Returns from today shows the returns from today if you buy the stock today. A positive expected returns indicates a profit you will make, a negative expected return indicates a loss you will make if you buy the stock. There are different strategies to apply in the stock market for profit and loss, pryogiTM will publish such strategies in the future to help you.

PryogiTM meter shows you predicted price, price on the date this prediction was published(report date) and price of the stock today on a price scale. This indicates if the stock price is moving towards or away from the predicted price

PryogiTM performance chart shows actual movement of stock price from prediction published date(report date) and if the price is moving towards or away from predicted price

Abbott posts strong Q3 growth across key segments, but tariff pressures and weak Diagnostics weigh on near-term momentum.

Abbott Laboratories ( NYSE:ABT ) reported muted sales in the third quarter on Wednesday and narrowed its fiscal 2025 guidance. The company reported third-quarter sales of $11.37 billion, slightly missing the consensus of $11.40 billion.

Abbott Laboratories ( NYSE:ABT ) reported muted sales in the third quarter and narrowed fiscal 2025 guidance on Wednesday. The company reported third-quarter sales of $11.37 billion, slightly missing the consensus of $11.40 billion. The U.S.

Investors should be able to count on these stocks to deliver steady and growing income over the long term.

U.S. stocks traded higher toward the end of trading, with the Nasdaq Composite gaining more than 100 points on Wednesday. The Dow traded up 0.06% to 46,299.96 while the NASDAQ climbed 0.52% to 22,639.61. The S&P 500 also rose, gaining, 0.33% to 6,666.08. Communication services shares jumped by ...

Wall Street rose on Wednesday, with investor optimism lifted by strong bank and corporate earnings alongside growing expectations for further Federal Reserve rate cuts - keeping trade concerns sidelined for now. The S&P 500 climbed 0.4% to 6,680, putting it within a single percentage point of ...

CCLA Investment Management disclosed a purchase of 66,275 shares of Abbott Laboratories ( NYSE:ABT ) , estimated at ~$8.70 million based on the quarterly average price, in its SEC filing for the period ended September 30, 2025, filed on October 14, 2025.According to a filing with the Securities ...

ABT's Q3 earnings meet expectations as revenues climb 6.9% year over year, driven by double-digit gains in Medical Devices.

Abbott Laboratories ( NYSE:ABT ) stock fell after the company reported muted sales in the third quarter and narrowed fiscal 2025 guidance. The company reported third-quarter sales of $11.37 billion, slightly missing the consensus of $11.40 billion.

U.S. stock futures advanced on Wednesday following Tuesday's mixed close. Futures of major benchmark indices were higher. Among the big banks that reported on Tuesday, surpassing analyst expectations were Wells Fargo & Co. ( NYSE:WFC ) , Citigroup Inc. ( NYSE:C ) , JPMorgan Chase & Co. ( NYSE:JPM ...

The CNN Money Fear and Greed index showed some easing in the overall fear level, while the index remained in the "Fear" zone on Tuesday.

With U.S. stock futures trading higher this morning on Wednesday, some of the stocks that may grab investor focus today are as follows: Wall Street expects Bank of America Corp. ( NYSE:BAC ) to report quarterly earnings at 95 cents per share on revenue of $27.50 billion before the opening bell, ...

Abbott Laboratories ( NYSE:ABT ) will release earnings results for the third quarter, before the opening bell on Wednesday, Oct. 15. Analysts expect the North Chicago, Illinois-based company to report quarterly earnings at $1.30 per share, up from $1.21 per share in the year-ago period.

Retail investors are preparing for the kick-off of the third-quarter earnings season, with big banks and other top stocks reporting this week. Here's a look at some retail favorites that individual investors will be watching. FAST stock is moving. See the real-time price action here.

CNBC's Jim Cramer walked investors through an earnings-heavy week on Wall Street.

ABT's Q3 results may show strength in Medical Devices and Nutrition, offsetting softness in Diagnostics.

Levin Papantonio attorney Sara Papantonio speaks to an audience of mass torts attorneys at the MTMP Spring 2025 conference. She will be updating attorneys on the NEC Preterm Infant Formula MDL at MTMP Fall 2025 at the Bellagio Hotel & Casino in Las Vegas, October 21-23.

A October filing shows that Representative Julie Johnson reported a sale in A.O. Smith ( NYSE:AOS ) , valued between $20,020 and $300,000. The transaction date is listed as September 25, 2025, with the report published on October 7, 2025. At present, A.O. Smith shares are trading up 1.99% at ...

BERKELEY, Calif., Oct. 08, 2025 ( GLOBE NEWSWIRE ) -- Channel Medsystems, Inc., a privately held company dedicated to advancing women's health with innovative solutions, announced today the appointment of Skip Baldino to its Board of Directors.

The time is right for buying more of these great dividend stocks.

AMD, Abbott and Micron showcase strong momentum as AI demand, medical innovation and memory recovery drive growth prospects.

Global Healthcare and Medical Device Executive with More Than 20 Years of Experience Assumes Role Effective October 1 Marla Beck Steps Down, With BeautyHealth Prepared for Its Next Phase of Growth

This fund makes it easy to invest in the top dividend stocks.

ABT gains momentum with strong FreeStyle Libre sales and Diagnostics growth but global macro headwinds weigh on performance.

These blue chip dividend stocks offer both income and growth potential.

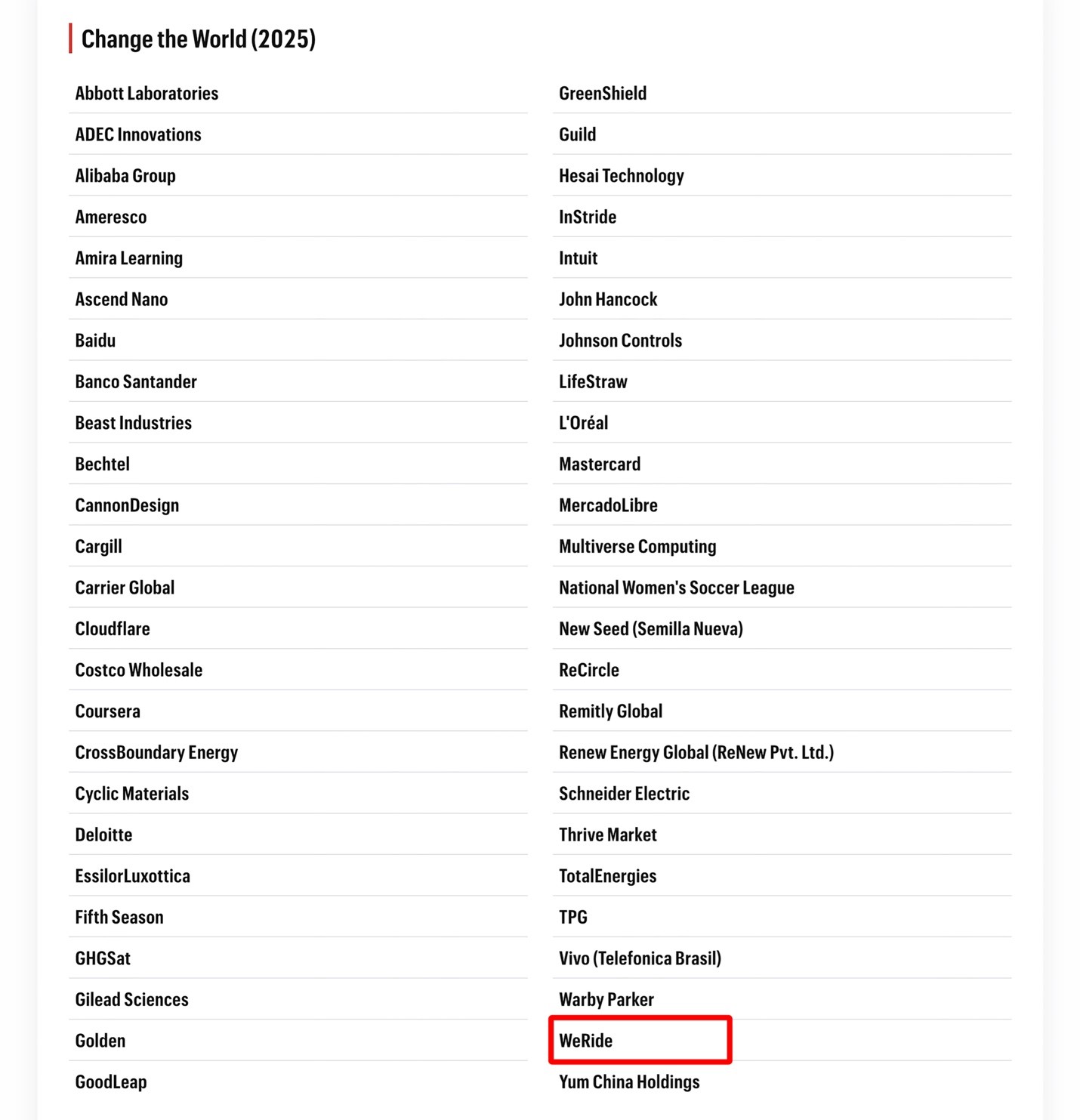

The company was also included in Fortune's 2025 Future 50 List for demonstrating strong long-term growth potential The company was also included in Fortune's 2025 Future 50 List for demonstrating strong long-term growth potential ...

It is dealing with some short-term issues, but its prospects remain bright.

The stock has outperformed the broader market since its 2013 IPO, and can still do so over the long run.

These businesses may be "boring," but that's a good thing in today's market.

These dividend powerhouses compound wealth through decades of consecutive increases and sustainable payout ratios.

Featuring the most innovative work and legal service lawyers have developed for their clients ...

At least 60 Dexcom G7 users report hospitalization, with multiple deaths alleged. FDA cited Dexcom for unauthorized material changes that impacted accuracy. Up Next: Wall Street trader's 35-0 strategy goes public this week. See it first → Hunterbrook Media released a short report on ...

Lewes, Delaware, Sept. 18, 2025 ( GLOBE NEWSWIRE ) -- The Global Neuromodulation Market Size is projected to grow at a CAGR of 9.27% from 2026 to 2032, according to a new report published by Verified Market Research®.

The attraction of these dividend stocks isn't limited to their dividends.

Dividends are powerful portfolio boosters, and AbbVie is a dividend dynamo.

September 11, 2025 records indicate that Representative Julie Johnson filed a sale of 3M MMM, valued between $59,059 and $885,000. According to the September filing, the transaction occurred on August 14, 2025. Currently, 3M shares are trading down 0.29% at $159.0.

Appointments strengthen Picard's Board with proven expertise in capital markets and global MedTech leadership Appointments strengthen Picard's Board with proven expertise in capital markets and global MedTech leadership ...

Zacks Analyst Blog spotlights Broadcom, T-Mobile, Abbott, CBL & Associates, and Crown Crafts with updates on growth, risks, and outlooks.

This company's past ability to extend patent-protected market exclusivity for its drugs bodes well for new investors.

There is more to like than the dividend with these companies.

Abbott wins CE Mark in Europe for expanded Navitor use, boosting its Structural Heart business and lifting ABT stock.

As the structural heart market expands, Abbott and Edwards battle for leadership. Which stock holds stronger growth momentum now?

The company's innovative devices have helped it generate decent performances.

ABT's gross margin hits 56.4% in Q2, fueled by Medical Devices growth, Nutrition strength, FX tailwinds and cost discipline.

Dr. Robert Lenz, Ms. Xin Liu and Dr. Sean Cao appointed to the Board of Directors Research and Development Committee established to accelerate innovation and long-term growth Dr. Ken Takeshita appointed to the Scientific Advisory Board

Investors will get great dividends and more with these stocks.

These high-yield dividend stocks are built to last.

Amazon, Salesforce, Abbott and Fossil Group show diverging trends as AI spending weighs on margins, healthcare pipelines expand, and retail turnarounds gain traction.